how to calculate my paycheck in michigan

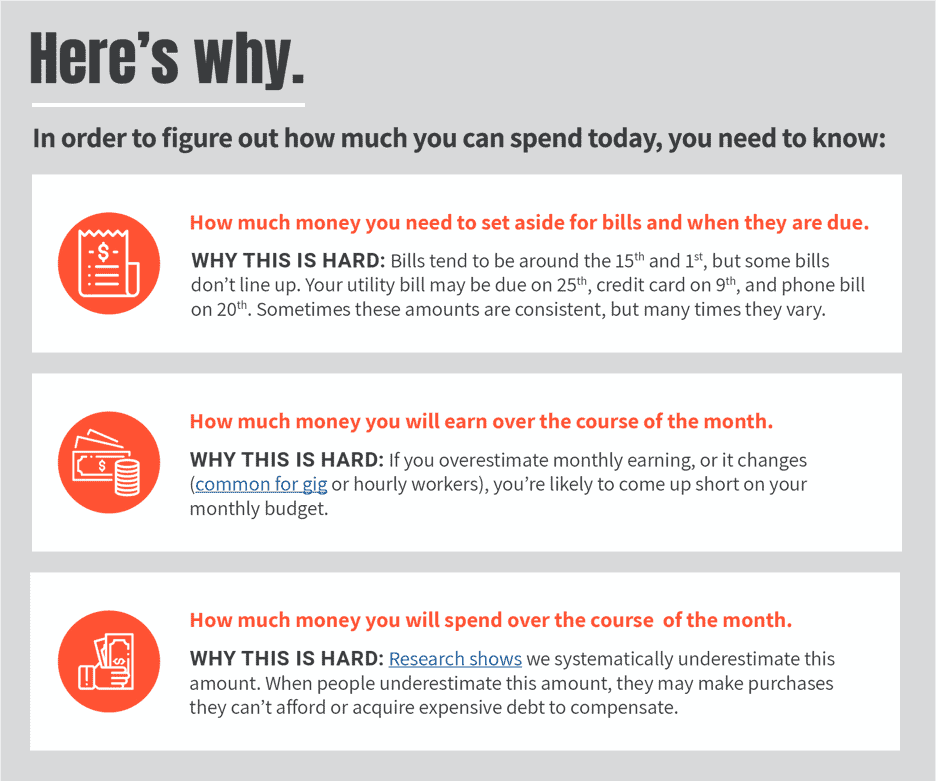

Use this Michigan gross pay calculator to gross up wages based on net pay. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

![]()

Income Tax Calculator 2022 Usa Salary After Tax

Plus you also need to factor in Michigans state unemployment insurance.

. This free easy to use payroll calculator will calculate your take home pay. But calculating your weekly take-home. How to calculate annual income.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is. Supports hourly salary income and multiple pay frequencies. This Michigan hourly paycheck.

It can also be used to help fill steps 3 and 4 of a W-4 form. This Michigan hourly paycheck. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Calculating your Michigan state income tax is similar to the steps we listed on our Federal. Step 6 Minus everything. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

Employers must report new or rehired employees within 20 days of hire through the Michigan New Hires Operation Center. The results are broken up into three sections. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Michigan Salary Paycheck Calculator. Processing payroll in Michigan is relatively straightforward.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. So the tax year 2022 will start from October 01 2021 to September 30 2022. Below are your Michigan salary paycheck results.

For employees who are paid an annual salary gross pay is calculated by dividing their annual salary by the number of pay periods in a year. Below are your Michigan salary paycheck results. Michigan allows employers to pay.

But these cities charge an additional income tax ranging from 15 to 24 for Michigan residents. For example if an employee earns 1500. For example if an employee receives 500 in take-home pay this calculator can be used to.

Once you have worked out your total tax liability you minus the money you put aside for tax withholdings every year if there is any and any post-tax. How do I calculate hourly rate. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Monthly Tax Tables 2019 from. This income tax calculator can help estimate your average. Use ADPs Michigan Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Next divide this number from the. Just enter the wages tax withholdings and other information required. The Michigan Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Michigan State.

The state income tax rate in Michigan is over 4 while federal income tax rates range from 10 to 37 depending on your income. How Your Paycheck Works. However complying with the various city income tax laws makes withholding.

Determining Alimony In Michigan In 2022

Avoiding The Downside Of Instapay Five Behavioral Science Based Principles To Make Paycheck On Demand Benefit Low Income Users Nextbillion

Paycheck Calculator Michigan Mi Hourly Salary

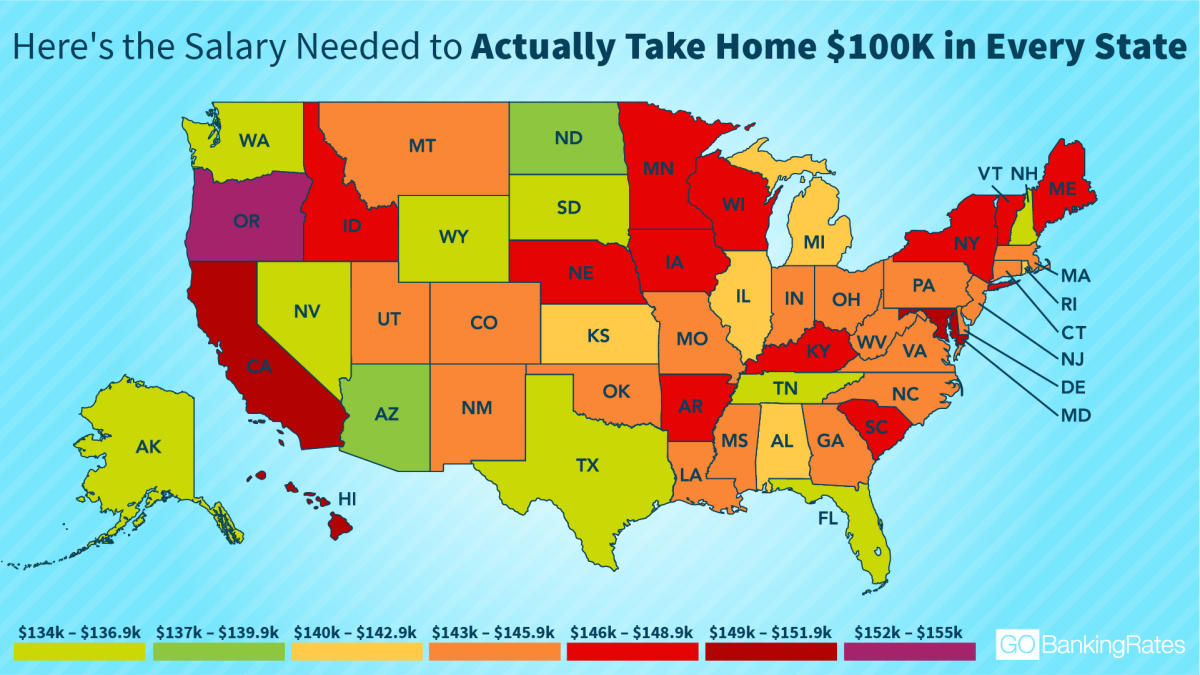

This Is The Ideal Salary You Need To Take Home 100k In Your State

Prorating Real Estate Taxes In Michigan

The Covid 19 Hazard Continues But The Hazard Pay Does Not Why America S Essential Workers Need A Raise

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Michigan Mistake Means Up To 650 000 Could Be Forced To Repay Unemployment Benefits Mlive Com

Michigan Estate Tax Everything You Need To Know Smartasset

The Covid 19 Hazard Continues But The Hazard Pay Does Not Why America S Essential Workers Need A Raise

A Complete Guide To Michigan Payroll Taxes

Paycheck Calculator Salaried Employees Primepay

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Llc Tax Calculator Definitive Small Business Tax Estimator

Statute Of Limitations For Discovery Of A Payroll Error

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Free Paycheck Calculator Hourly Salary Usa Dremployee

Tax Withholding For Pensions And Social Security Sensible Money